do you pay taxes on a leased car in texas

The lease contract is not subject to tax. Howeverm i did fill out a 50-285 affidavit and submitted with my lease paperwork.

Mini Electric Hardtop 2 Door Lease Austin Tx Mini Of Austin

A leasing companys income.

. The lessee does not have to pay any property taxes on the vehicle. Technically there are two separate transactions and Texas taxes it that way. Unless exempt by state law or federal law all property in Texas is taxable.

Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. Do I owe tax if I bring a leased motor vehicle into Texas from another state. Any tax paid by the.

Instead you can pay your sales tax over the term of your lease. Most states incorporate sales tax into the monthly car rental payment although some states require that the full sales tax on all your rental payments be paid in advance. No tax is due on the lease payments made by the lessee under a lease agreement.

When youre leasing a car you dont have to pay sales tax upfront. Even if you bought it back from Audi youd still have to pay taxes. When the vehicle is purchased and titled in.

In Texas leases of vehicles are not taxable. The monthly rental payments will include this. In a couple of states such as Texas lessees must pay sales tax on the full value of the leased car versus just the tax on payments during the time of the lease.

Instead sales tax will be added to each monthly lease. I leased a vehicle at the end of 2019. When you lease a car in most states you do not pay sales tax on the price or value of the car.

In Texas lessees of a motor vehicle purchasing it for lease do not owe any sales tax. This means that you will have to pay taxes on your leased car. Didnt receive a tax bill for that year.

A car lease acquisition cost is a fee charged by the lessor to set up the lease. Yes in Texas you must pay tax again when you buy your off-lease vehicle. Acquisition Fee Bank Fee.

When a vehicle is leased in another state and the lessee brings it to Texas. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor. Do I have to pay taxes on a leased car.

Its sometimes called a bank fee lease inception fee or. Even if you refinanced it at UFCU down the street youd have to pay taxes. Yes you absolutely have to pay taxes.

If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. In some states such as Georgia you pay a title ad valorem tax up front on the capitalized lease cost or lease price see Georgia Car Lease for recent changes.

What S The Car Sales Tax In Each State Find The Best Car Price

Do Auto Lease Payments Include Sales Tax

The Top Is There Sales Tax On A Leased Car In Texas

Leasing A Car Here S Why You Can Get A Good Deal If You Buy The New York Times

Honda Pilot Lease Deals Round Rock Tx Round Rock Honda

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Registering A Leased Vehicle In Texas Rentall

Bmw 5 Series Lease Deals Austin Tx Bmw Of Austin

Bmw X2 Lease Incentives Prices Austin Tx

Lease A New Toyota From Mike Shaw Toyota In Corpus Christi Tx

Hyundai Tucson Lease Prices Round Rock Tx Round Rock Hyundai

Help With Taxes In Texas Ask The Hackrs Forum Leasehackr

Can Taxes Paid On A Leased Vehicle Be Written Off On Federal Taxes

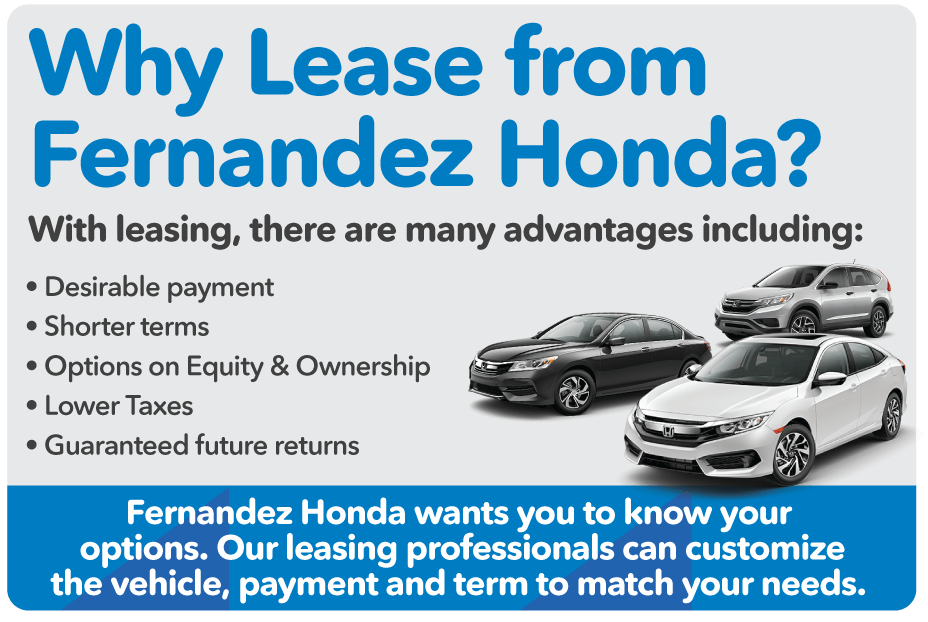

Honda Lease Deals In San Antonio Tx Fernandez Honda

Buying Vs Leasing Houston Tx West Houston Vw

Do You Pay Sales Tax On A Lease Buyout Bankrate

Bmw 8 Series Lease Incentives Prices Austin Tx

Confusion Regarding Property Taxes On Leased Vehicles In Texas